ATI & OECD FTA Workshop Series

Digitalisation and digital transformation are important to improve the efficiency and efficacy of revenue administrations. The use of information technology can aid in improving revenue and reducing taxpayer burdens, being an ally of revenue administrations and governments in partner countries in their pursuit for ways to collect the revenue necessary to fund public services under the context of the post-COVID-19.

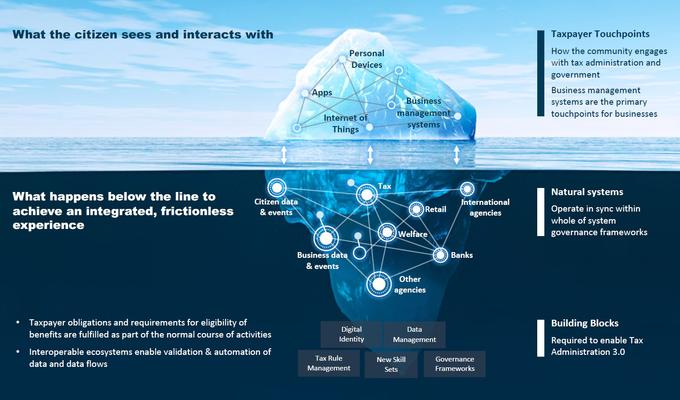

Assessing the current status of revenue administrations on this matter is a crucial first step for making improvements. The Secretariats of the Addis Tax Initiative (ATI) and the OECD’s Forum on Tax Administration (FTA) are therefore currently co-arranging a series of three workshops on using the FTA’s Digital Transformation Maturity Model (DTMM). The DTMM allows a tax administration to assess their current level of maturity with regard to digitalisation and digital transformation. The assessment results can be used when considering the strategy for digitalisation and digital transformation. The model is meant to be used by administrations on different maturity levels, from those in early stages of digitalisation via those partially or fully digitalised to those whose tax processes are underway to be digitally transformed and embedded in societal systems.

The first workshop in the series was arranged on 26 October 2022, bringing together tax administration officials from ATI partner countries Benin, Ecuador, Kenya, Madagascar, and Sierra Leone, as well as representatives from donor countries and organisations working closely with these countries, including the German Development Cooperation (GIZ), the World Bank (WB), and the Swedish Tax Agency. The focus in this workshop was building motivation for performing the DTMM-based self-assessment, understanding the process of self-assessment, and studying the content of the model. Ms Michelle ORDÓÑEZ from the ATI Secretariat moderated the session, and Mr Vegard HOMEDAHL from the FTA Secretariat provided a three-part presentation: Motivation and overview; model concept and process; model building blocks.

Between and after the presentations, participants engaged in an active discussion and exchange. One of the questions raised was whether there is a pool of certified facilitators that can assist administrations. Mr HOMEDAHL explained that the OECD is currently working on an e-learning module that will help facilitators prepare, including facilitating self-assessment for other administrations.

Another topic discussed was the level of preparedness for change within and outside the administration. As pointed out by Mr HOMEDAHL, successful digitalisation within the tax administration is closely related to the level of digitalisation of the society, and on this path building trust among all parts involved is central. Ms ORDÓÑEZ highlighted that the latter is a key element of the discussions among ATI members, and invited attendees to join an ATI webinar which will address the importance of building trust and incorporating accountability into taxpayer education and citizen engagement, as this can improve tax morale and compliance, increase tax revenues and strengthen the progressivity of tax systems. In his closing remarks, Mr HOMEDAHL confirmed that he will be available for questions or comments during the DTMM-based self-assessment process.

In the second workshop, which will be held in March 2023, participants will share their experiences, challenges and insights from their self-assessment processes, while the third workshop will focus on using self-assessment results when developing or revising a digital strategy.

Revenue administrations that are interested in participating in similar workshops or have questions related to the DTMM can contact one of the Secretariats at secretariat@taxcompact.net or FTA@oecd.org.