The Addis Tax Initiative at the 15th WATAF General Assembly

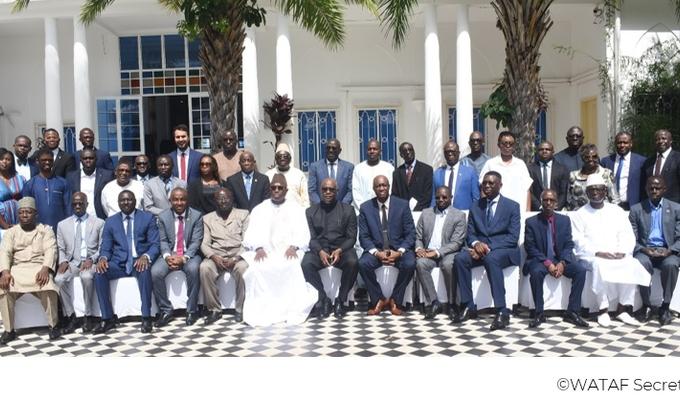

The West African Tax Administration Forum (WATAF) held its 15th General Assembly in Banjul, The Gambia, from 18 to 19 September 2019. Delegates from Ministries of Finance and tax administrations of 15 ECOWAS member countries, development partners, civil society organisations, regional parliamentarians, academia and tax practitioners participated in the High Level Policy Dialogue on Domestic Revenue Mobilisation (DRM). The convening was intended to jointly develop a DRM strategy framework for West African countries, while drawing attention to the African Union Agenda 2063 and the United Nations 2030 Agenda for Sustainable Development.

The Secretariat of the Addis Tax Initiative (ATI), which is facilitated by the International Tax Compact (ITC), was invited to present updates on the ATI to WATAF members. The discussions focused on the progress highlighted in the 2017 ATI Monitoring Report, the findings of the ATI Study on Donor Coordination and the process for the ATI beyond 2020. Participants valued the soon to be launched online ATI matchmaking as a potential catalyst for more effective development partner support in DRM.

WATAF addresses the need for West African tax administrators to cooperate and actively promote improvement in tax administration through better service delivery, taxpayer education, effective use of automated systems, countering tax evasion and aggressive tax planning, and strengthening audit and human resource management capabilities in their respective administrations. WATAF was established to contribute to the efficacy of tax administrations and improved public service delivery in support of the West African countries’ development. WATAF has been cooperating with, contributing to, and advocating for the ATI as a supporting organisation since its launch.

For further information, please find the outcome statement of the conference here.