Season's Greetings & Happy New Year from the International Tax Compact

Dear colleagues and friends,

2023 has been a remarkable year for the International Tax Compact (ITC)! The ITC, in pursuit of its vision of fair, efficient, and transparent tax systems for sustainable development, continued to provide secretarial services to the Addis Tax Initiative (ATI) and the Network of Tax Organisations (NTO). Throughout the year, ATI and NTO have welcomed new members, hosted global conferences and workshops, and conducted capacity-building activities on relevant tax-related topics.

In this year-end review, we are delighted to highlight some of ATI and NTO’s achievements in the past 12 months. These milestones would not have been possible without the continuous support and dedication of our members and partners.

We look forward to your engagement and trust in 2024. Wishing you a fantastic year ahead!

Sincerely,

Your team at the ITC

The Addis Tax Initiative (ATI)

ATI Governance

- Under the theme “Stepping up financing for sustainable development”, the 2023 ATI General Assembly (GA) brought together more than 180 participants from ATI member countries and organisations in Lusaka, Zambia, and online. Held in June, the event provided a platform to reflect on the achievements of the ATI since its establishment in 2015, and to address persistent challenges. The ATI GA featured technical sessions on tax gap estimation, DRM support coordination, digital economy taxation, and challenges in environmental taxation. The 2023 ATI GA report is available here.

📘 During the forum, three ATI publications were launched: the study “ATI partner countries’ perspectives on tackling tax-related illicit financial flows (TIFFs)”, the discussion paper “Country ownership in technical assistance for DRM”, and brief on ATI partner countries’ perspectives from moving towards equitable tax systems.

- In 2023, the ATI Steering Committee comprised representatives from Ecuador, Georgia, and Rwanda as partner countries, as well as the European Union, France, and the United States as development partners. Headed by two co-chairs, the Committee provides strategic guidance and monitors the progress made towards reaching the goals defined in the ATI Declaration 2025.

The ATI in the international fora

- In collaboration with the European Union and Germany as ATI development partners, the ATI hosted a side event in the margins of the UN ECOSOC Financing for Development Forum (FfD), held in New York in April. The event focused on the role of Integrated National Financing Frameworks (INFFs) as a mechanism for countries to align their financing strategies with their national development priorities and the Sustainable Development Goals (SDGs).

- In November, the ATI co-hosted a session at the UNDP’s Dialogue on Tax and SDGs 2023, held in New York, in collaboration with the Swedish Tax Agency (STA). Aligned with Commitment 4 of the ATI Declaration 2025, the session “Strengthening Tax Compliance Through Technical Assistance” discussed the potential of collaborative approaches of bilateral and multilateral support programmes to promote taxpayer trust in developing countries.

Strengthening revenue collection in partner countries

- Subnational taxation: In July, the ATI, in partnership with the Local Government Revenue Initiative (LoGRI) launched the workshops series “Policy Design for Effective Property Taxation”, which aimed to provide a space for exchange and hands-on advice on the design of property taxation policies. The insights and recommendations gathered throughout the sessions are compiled in factsheets, available here.

- Digitalisation of tax administrations: In 2023, the ATI continued its engagement with the OECD’s Forum on Tax Administration (FTA) in a workshop series on the Digital Transformation Maturity Model (DTMM). The second session took place in March, and the third and last session was held in May, concluding the series on how to use the OECD FTA’s DTMM to improve the efficiency of revenue administrations through digitalization and digital transformation.

- Revenue reform strategies: In February, the ATI organised the webinar “Partner countries’ experiences with formulating and implementing national revenue strategies”. The session presented experiences in formulating and implementing the Medium-Term Revenue Strategy (MTRS) and other types of national revenue reform strategies. Contributions from experts and practitioners underscored the role MTRS can play in meeting national revenue goals and other development objectives.

Increasing transparency and advancing reforms of Tax Expenditures

- The series of regional workshops on tax expenditures (TEs) launched in 2022 by the ATI in partnership with the Council on Economic Policies (CEP) and the German Institute of Development and Sustainability (IDOS) continued throughout 2023. The third regional workshop, with a focus on Asia, took place in Manila (the Philippines) in March 2023. In September, we kickstarted the continuation of the series with the first ATI Follow-up Technical Meeting on Tax Expenditures for West Africa in Accra (Ghana), which further developed the network established in Lagos (Nigeria) last year. Similarly, building on the insights gained in Nairobi in 2022, the second ATI Follow-up Technical meeting on TEs with a focus on East Africa was held in Dar es Salaam (Tazania) in December 2023. The ATI celebrates the progress made in the realm of tax expenditures as well as the flourishing of regional networks of experts in the field.

-

As part of the Economic Commission for Latin America and the Caribbean (ECLAC)’s Regional Technical Meeting on tax expenditures in November in Mexico City, the ATI Secretariat presented its work to promote transparency around TEs and enhance their assessment and evaluation. This way, the ATI aims to contribute to and support the discussion on TEs in the Latin American region.

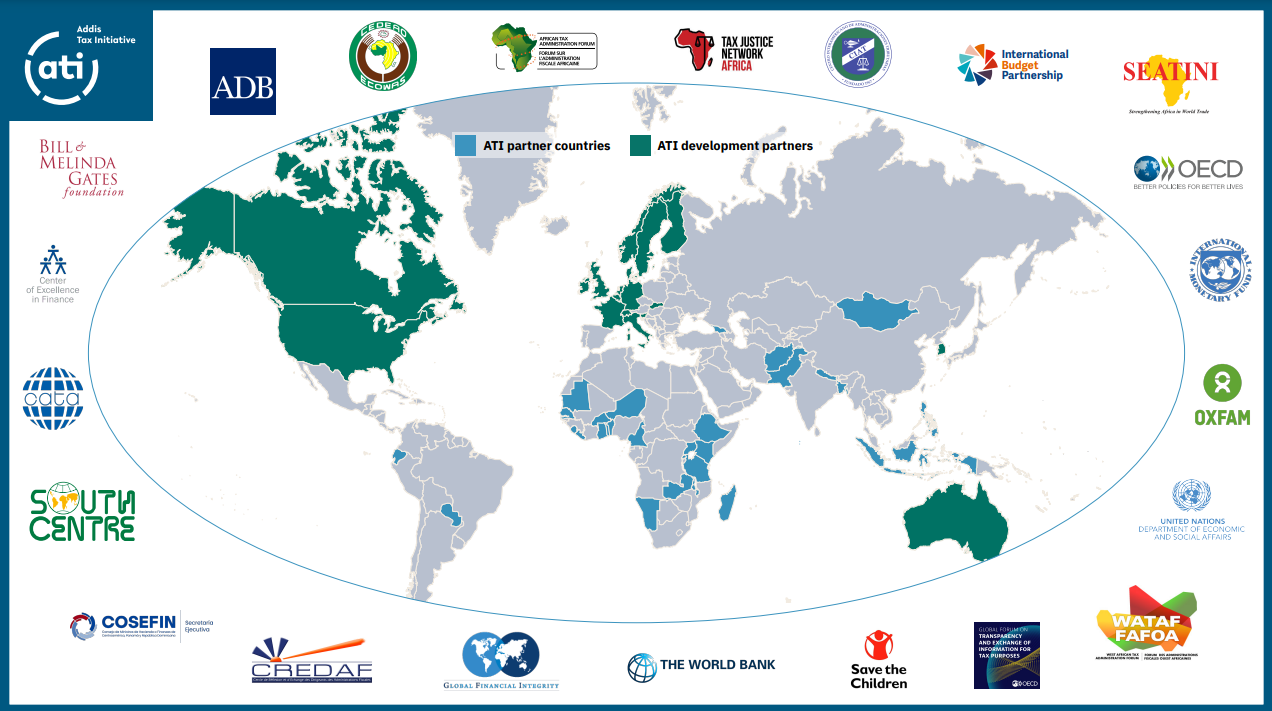

New members

- In 2023, the ATI welcomed four new members, the Economic Community of West African States (ECOWAS) and the Southern and Eastern Africa Trade Information and Negotiations Institute (SEATINI) as supporting organisations, and Bangladesh and the Maldives as partner countries. The ATI now comprises 74 members with a shared dedication to building tax systems that benefit people and advance the Sustainable Development Goals (SDGs). We look forward to jointly working towards the implementation of the ATI Declaration 2025!

The Network of Tax Organisations (NTO)

2nd NTO Technical Conference

- “Digitalisation of Tax Administrations and Contemporary Issues” was the theme of the 2nd NTO Technical Conference, which took place in Cape Town (South Africa) from 5-7 September. The event was attended by 162 on-site and 568 online participants. Organised by the NTO and hosted by the African Tax Administration Forum (ATAF), the Conference brought together representatives from international organisations, academia, tax leaders, fiscal policy experts, government revenue officers, and IT specialists to share insights on the digital transformation of tax administration, tax compliance and enforcement technology, and emerging technologies. To learn more, access the dedicated site.

NTO as a global platform for peer exchange & collaboration

- In April, the NTO conducted the webinar on “Mainstreaming gender in tax administrations”, providing insights into tackling gender inequality in the area of taxation, with a specific focus on tax administrations. The session featured the perspectives of representatives from the Foreign Commonwealth and Development Office (FCDO) in Pakistan, the Zambia Revenue Authority (ZRA) and ATAF.

- Under the theme “Emerging technologies for tax administrations”, this NTO webinar which took place in July brought together experts to discuss the risks, benefits, and challenges of Information and Communications Technologies (ICT), focusing on lessons learnt from country case studies.

- In October, the NTO organised a study visit to promote peer learning among its member Secretariats. For two weeks, a representative from the Intra-European Organisation of Tax Administrations (IOTA) and another from the Pacific Islands Tax Administrators Association (PITAA) visited the Inter-American Center of Tax Administrations (CIAT) headquarters to exchange on the administration of technical co-operation projects and process management.

New member

- In 2023, the NTO welcomed its 10th member: the Study Group on Asia-Pacific Tax Administration and Research (SGATAR), a forum for knowledge exchange and cooperation among tax administrators in the Asia-Pacific region. This new addition expands NTO’s global network’s reach and expertise to Asia, and reinforces NTO’s commitment to enhancing and strengthening tax administrations worldwide.

NTO Governance

- In December, the 6th Network of Tax Organisations (NTO) General Assembly gathered representatives of the NTO member organisations to monitor the progress and implementation of the 2023 work plan, validate the 2024 plan, and discuss the future of the network. The meeting, held in Rome (Italy) and hosted by the Italian Revenue Agency, served as a forum to deliberate on the NTO’s strategic plans and development in the forthcoming years.