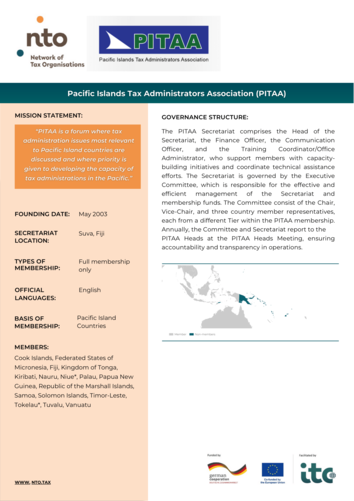

Pacific Islands Tax Administrators Association

About

The Pacific Islands Tax Administrators’ Association (PITAA) serves as a platform for information exchange. PITAA offers a forum for cooperation and coordination in the area of exchange of information and policy formulation. Further, the network promotes international standards and best practices in the region as well as the modernisation of tax administrations. To reach these goals, PITAA organises capacity-building measures and facilitates the exchange of knowledge, data and experiences. PITAA accounts for 16 member countries.

Objectives

- Improve effectiveness and efficiency of tax administrations

- Regional and international partnership and cooperation

- Forum for exchange

- Technical assistance

Activities

- Conferences

- Publications

- Seminars and workshops

Organisational Structure

Secretariat

Responsibilities

- Carries out activities to support the members in improving their capacity and capabilities

Heads of Membership Meeting (annually)

Responsibilities

- Supreme decision-making body of PITAA

- Adopts the agenda and approves applications for membership and observers

- Identifies projects consistent with the objectives of PITAA

- Approves project timetables

- Established project committees

Executive Committee

Members

- Chair of the PITAA Heads Meeting, Vice-Chair, three representatives

Resources

- Support from donors, mainly PFTAC (Pacific Financial Technical Assistance Centre) and World Bank